Terms and Conditions

• These terms and conditions will form an agreement (the “Agreement”) between you (“you”), the customer, and us, Pay+ a joint venture between National Bank of Oman (NBO) and Omani Qatari Telecommunications Company SAOG. (“Ooredoo”, “us” or “we”), upon successful completion of your registration as a Wallet Account Holder.

• “Airtime” means in the case of Prepaid customers only, the balance on your SIM card

• “ALIAS” is an alternative name assigned to a customer account/wallet opened with a PSP that can be used as an alternative way of identifying an account rather than using the actual mobile number.

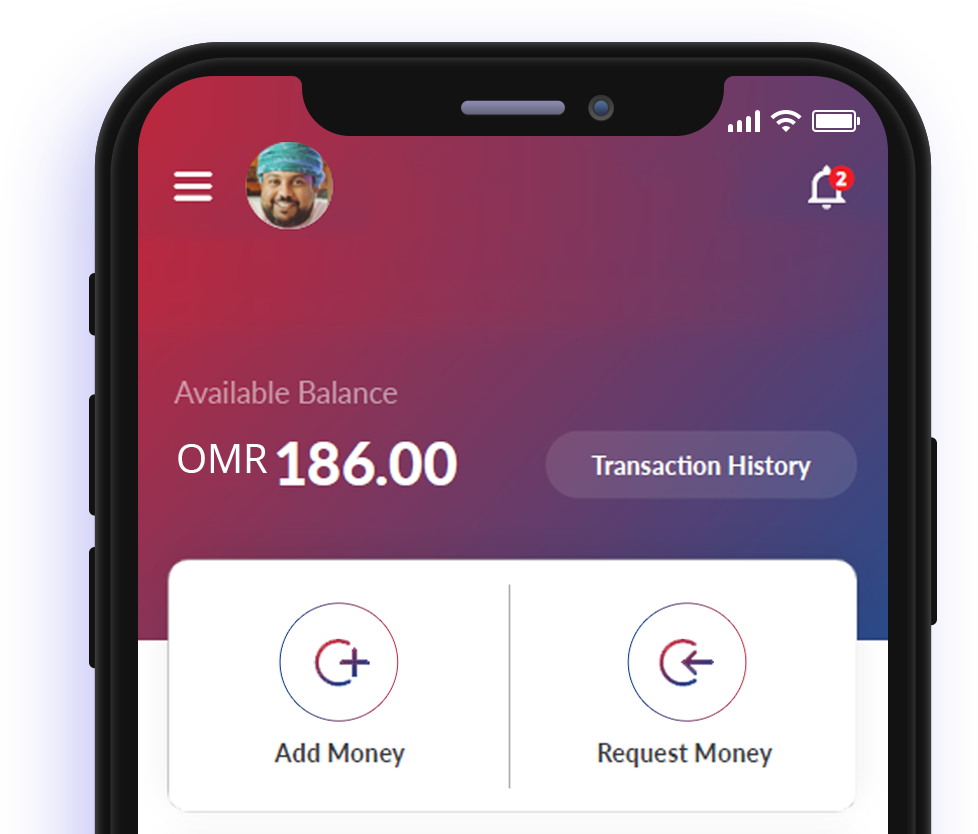

• "Available Balance" means the amount of E-money in your Wallet Account at any time.

• “Call Centre” means the Ooredoo call centre that can be contacted by phone at 80001111. The Call Centre will be open 24 hours a day seven days a week and 365 days a year.

• “CBO” stands for Central Bank of Oman “Commercially Reasonable Efforts” means the carrying out of obligations or tasks by a party in a sustained manner using good faith commercially reasonable and diligent efforts, which efforts shall be consistent with the exercise of prudent business judgment.

• “Dispute” is a situation in which a customer questions the correctness of a transaction and or seeks clarity or resolution. “E-money” means money in any particular currency recorded electronically in the Wallet Management System, that has the same value as cash in the designated currency.

• “Equipment” means your mobile phone and SIM card used to effect transactions on Mobile Wallet.

• “Force Majeure” includes without limitation acts of God, default or failure of a third party, natural causes (such as severe weather, storms, hurricanes, typhoons, tsunamis, earthquakes, lightning, floods, widespread fires or any other natural disaster), epidemics of infectious deceases, war (whether declared or not), riots, industrial action, civil unrest, acts of terrorism, rebellion, revolution, insurrection, military or usurped power or confiscation, blockage, embargo, labor dispute, strike, lockout or interruption or failure of electricity, equipment failure including your Equipment or the equipment of any third party, computer or software malfunction, interruption or disruption of our Network or the networks of other service providers, nationalization, governmental action or any act or decision made by a court of competent jurisdiction.

• “Passcode” means your personal identification number used to log on to the Service.

• “Network” means the mobile telecommunications network operated by us in Oman.

• “PSP” stand for Payment Service Provider. These are the Banks licensed by CBO under the extant law in force, and any other entity licensed to provide mobile payment services through the CBO's Mobile Payment System to the banked and unbanked customers.

• “Permitted Destination” means any country to which you may send money using the Service - these countries are listed on our Website at https://www.PayPlus.om

• “Oman” means the State of Oman.

• “Oman Central Bank” or “CBO” means the central bank of Oman.

• “Omani Riyals” means lawful currency of Oman.

• “Mobile Payments System” is a unique payment solution provided by CBO. This service can be used by any customer having Account or Wallet with NBO and is a registered user of NBO Mobile Banking application. Customer can make the payment by scanning the QR code available at merchant stores, websites, Bills, etc.

• “Mobile Wallet” or the “Service” means the service we provide to you through which you may carry out Transactions as described in this Agreement.

• “NBO” means National Bank of Oman, a shareholding company incorporated under the laws of Oman.

• “Ooredoo Agent” means a retail outlet, store or other location where you can sign up for the Service as listed on the Website.

• “Merchants” means any location that accepts E-money using QR Code payment for goods and services.

• “Ooredoo Outlet” means a retail Outlet, store or other location listed on our Website where you can load E-money into your Wallet Account or withdraw E-money from your Wallet Account in Omani Riyals.

• “SIM card” means a secured subscriber identity module card that enables a Wallet Account Holder to access the Service and other services provided by Ooredoo.

• “SMS” means short message service or text message sent to your phone.

• “Transactions” has the meaning set forth in Clause 5.

• “Transaction Limits” means the limits in Omani Riyals applicable to transactions that you can carry out using the Service, in each day or each month, that are set forth on the Website at https://www.PayPlus.om

• “Transfer Instructions” means instructions using the Service to carry out Transactions using your Equipment.

• “Wallet Account” means your account maintained by Mobile Wallet which records the amount of E-money you have.

• “Wallet Account Holder” means the holder of a Wallet Account.

• “Wallet Account Holder Information” means any information associated with a Wallet Account Holder relating to its use of the System.

• “Wallet Management System” or the “System” means the Pay+ ecosystem operated by NBO and Ooredoo in which all Wallet Account balances and transactions of Wallet Account Holders are recorded

• The Service will begin from the date of approval of your registration and remain effective unless terminated in accordance with this Agreement.

• By subscribing to the Service you confirm that you are at least 18 years old.

• You may use the Service to carry out the following transactions (“Transactions”) using your Equipment:

(a) Send E-money to another customer’s Mobile Wallet account in Oman;

(b) Send E-money to a bank account in Oman;

(c) Remit E-money to any person at a Permitted Destination;

(d) Purchase Airtime using E-money;

(e) Purchase goods and services from Merchants; and

(f) Load E-money into your Wallet Account direct from your bank account.

• You authorize us to process your Transfer Instructions confirmed with your Passcode made using the Pay+ application or at any Ooredoo Outlet or Merchant.

• pay+ services are powered by NBO and Ooredoo. NBO is regulated by CBO and Ooredoo is regulated by Telecommunications Regulatory Authority.

• NBO holds all Wallet Account balances in a special pool account in Oman for the benefit of all Wallet Account Holders.

• You may use the Service while travelling outside Oman in which case roaming charges will apply.

• Use of the service for making payments constitutes your acceptance of the terms and you agree to abide by it.

• In addition, when using Mobile Payments System, you shall be subject to any guidelines or rules applicable to use of this services as advised by Central Bank of Oman.

A. You agree that the Pay+ will be required to register your wallet account with Central Bank of Oman and associate/link it the mobile number provided as part of your “KYC” information.

B. You agree that usage of the Wallet service, will represent your acceptance of this Terms and Conditions, and that continued use of wallet system after revisions to this Terms and Conditions shall constitute your agreement to such revised terms and any applicable posted guidelines or rules.

C. Unless explicitly stated otherwise, any new features that augment enhance or otherwise change Mobile Payments System shall be subject to this Terms and Conditions.

D. Pay+ reserves the right at any time to modify or discontinue, temporarily or permanently, payment using Mobile Payments System services.

E. Pay+ shall not be responsible for interception/ misuse of Mobile Payments System. Pay+ is not liable if the Authentication and customer's registered device fall into wrong hands due to any reason whatsoever

F. Pay+ shall not be liable if a transaction through Mobile Payments System does not materialize or is delayed or is incomplete due to any reason whatsoever

G. Except as otherwise provided by Applicable Law or Terms and Conditions applicable to the Wallet Account, you understand that you are financially responsible for all uses of the Mobile Payments System payment services by you and those authorized by you during the registration and payment.

H. Misuses of Mobile Payments System service: You acknowledge that if any third person obtains access to your Wallet application or your registered device, such third person would be able to carry out transactions. You shall be responsible for all transactions carried through Mobile Payments System on your account.

I. Internet Frauds: The Internet per se is susceptible to a number of frauds, misuses, hacking and other actions, which could affect use of Mobile Payments System service. Whilst the Bank shall aim to provide security to prevent the same, there cannot be any guarantee from such Internet frauds, hacking and other actions, which could affect the use of the Mobile Payments System.

J. Technology Risks: It may also be possible that the Banking Application may require maintenance and during such time it may not be possible to process the request of the Customers. This could result in delays in the processing of Instruction or failure in the processing of instructions and other such failures. You understand and acknowledge that the Bank disclaims all and any liability, arising out of any failure or inability by the Bank to honor any customer instruction.

K. Limits: You are aware that Pay+ may from time to time impose maximum and minimum limits on the Mobile Payments System payment. You realize, accept and agree that the same is to reduce the risks on you. You shall be bound by such limits imposed and shall strictly comply with them.

L. Authentication: You are aware that the Pay+ allows you to keep yourself logged in, in order to do the payments (to other mobile numbers, Alias or QR Codes) without needing to login to the Pay+ Application every time. You realize, accept and agree that such relaxation in Authentication is provided by Pay+ is to simplify your payment process. Pay+ does not enforce to use this feature and enabling this feature is completely at your own discretion. By allowing such payments, you accept that Pay+ is not responsible or liable for any fraud or misuse that may be caused due to allowing of payment without login each time.

M. Transaction Authorization: You are aware that the Pay+ allows you to do the payments (to other mobile numbers, Alias or QR Codes) without needing to enter One Time Password(OTP) if the transaction amount is up to OMR 10, Pay+ at its discretion may change this amount at any time without sending any notice. You realize, accept and agree that such relaxation in Transaction Authorization is provided by Pay+ to simplify your payment process. By allowing such payments without OTP, you accept that Pay+ is not responsible or liable for any fraud or misuse that may be caused due to allowing of payment without login each time.

N. You are aware that Pay+ allows you to receive payments using QR Code, Mobile Number or Alias that has been associated/linked to your account/wallet. If you link your mobile number with account or wallet with some other bank/PSP, the account/wallet associated with the same mobile number at Pay+ will be automatically dissociated/delinked.

O. Indemnity: You shall indemnify Pay+ for and against all losses and damages that may be caused to NBO or Ooredoo as a consequence of breach of any of the Terms and Conditions governing the use Mobile Payments System services.

P. Refund Policy: All payments made using Pay+ App are final with no refund or exchange permitted. You are responsible for the mobile number or Alias Name or QR Code or Bill Details and all charges that result from those purchases. Pay+ is not responsible for any purchase or payment to incorrect mobile number or Alias Name or QR Code or Bill Details. However, if you dispute a transaction performed by You on the Pay+ App, then You shall inform us by tapping on the dispute icon next to the transaction details in Pay+ App. Pay+ will investigate the incident and, if it is found that money was indeed charged to Your wallet account without delivery of the required service, then You will be refunded the money within 180 days from the date of receipt of Your dispute. All refunds will be credited to Your wallet account.

(a) To access the Service, you must register using the Pay+ applicaton by presenting a valid Omani identity card or Omani expatriate resident card and your smart selfie. The registration can be rejected for reasons such as invalid ID proof, unclear selfie, insufficient data or any other reason whatsoever that does not adhere to the registration requirements.

(b) Upon registration, you will enter a number combination as your Passcode. Please take all necessary security measures to protect your Passcode and we suggest you do not use your phone number or date of birth or any easiy identifiable information as your Passcode. Please change your Passcode frequently. You will be responsible for its security by keeping the Passcode confidential at all times. We recommend you commit it to memory.

(c) If access to the Service is made by any third party by use of your Passcode with or without your authorisation, we shall consider that the Service has been accessed properly and the transaction conducted is valid.

(d) If a wrong Passcode is entered more than three times, the Wallet Account of that Wallet Account Holder will be automatically suspended temporarily. Should you wish to reactivate the Service, you should contact the Call Centre.

(e) Once your application has been accepted and you have successfully registered, you may use the Wallet Account as follows:

(i) To buy E-money from any Ooredoo Outlet.

(ii) E-money may be sent to your Wallet Account by your employer or any other person.

(iii) You may transfer E-money to your Account by sending funds from your bank account.

(iv) With an Available Balance you may carry out Transactions.

(v) A Transaction will not take place if you have insufficient E-money in your Wallet Account to cover the amount of E-money you want to send and related charges. We will notify you that the transaction will not take place in such circumstances.

(vi) A Transaction that exceeds the Transaction Limits will not take place.

(vii) We carry out identity and security checks when we receive your Transfer Instructions and may refuse any transaction if we are not satisfied with the results of our checks.

(viii) We will confirm all successful Transactions sent or received by a notification message or sending you an SMS with your new Wallet Account balance with a Transaction number – these numbers are used to identify all transactions carried out in your Wallet Account.

You undertake to us as follows:

(a) The information provided to us for the purpose of registration for the Service is true and correct.

(b) You will provide any additional information that we may request from time to time relating to your registration, failing which we may suspend or terminate the Service.

(c) The information provided by you may be held on a database and we may use, store, analyse and transfer or exchange such information with all such persons as may be considered necessary by us without reference to you: you agree that your information may be treated in such manner by us. You agree to opt-in for Pay+ and partner related marketing and advertising. You may opt-out of this feature at any time – see https://www.PayPlus.om

(d) You will comply with this Agreement.

(e) You will comply with all applicable laws, statutes, rules, regulations, notices, instructions or directives of the relevant authorities or any notices, instructions, directives or guidelines given by us in connection with the Service by publication on the Website or through the media.

(f) You have not fraudulently registered with us for use of the Service. If we discover that you are impersonating another customer, whether an individual or another legal entity, you shall be responsible for any liability that may arise as a result of such fraudulent activity. Abusing the Service may result in its immediate termination or suspension and we shall notify the relevant authorities promptly of such abuse.

(g) You shall not use the Service for any illegal activity under applicable laws.

(h) You will comply with the Transaction Limits applicable to any Transaction from time to time.

(g) You shall not use the Service for any illegal activity under applicable laws.

(i) All records of Transactions relating to your device will be binding on you and act as conclusive evidence of your registration for the Service.

(j) You shall be responsible for all your Transactions. Pay+ shall provide you with Transaction history of your Wallet Account under transaction history in the wallet app or on request by you to the Call Centre.

(k) The use of the Service is subject to such other terms, conditions, rules and regulations as specified by CBO or any other regulatory or governmental authority from time to time.

(l), the Service is not transferable or assignable to any third party. We shall not be liable for any costs, loss or damage (whether direct or indirect), or for loss of revenue, loss of profits or any consequential loss as a result of your transferring or assigning the Service to any third party.

(m) The Wallet Account cannot be pledged or used in any manner by you as any form of security in favor of any third party for any purpose. We shall not be liable for any costs, loss or damage (whether direct or indirect), or for loss of revenue, loss of profits or any consequential loss as a result of your using the Service as a form of security.

(n) You will be responsible for checking and verifying all Transactions including, without limitation, the amount and recipient information. We shall not be obliged to reverse a wrongful entry as a result of your error or mistake.

(o) You will immediately notify Pay+ upon receipt of incomplete and inaccurate data or information or any data which is not intended for you. You shall delete such data or information from your Equipment.

(p) You will use your Wallet Account only for personal use and not for any commercial business whether directly or indirectly. If we determine that you have violated this undertaking, we will close your account(s) in accordance with the instructions of CBO and the Omani Ministry of Economy and Commerce.

(q) You are the only person entitled to E-money in the Wallet Account.

(a) The remittance of money outside Oman to a beneficiary’s account will be subject to the prevailing exchange rate as determined by us.

(b) We will not pay interest on any E-money held in your Wallet Account.

(a) The Service is provided on an “as is” basis without any representations of any kind whether express or implied as permitted by law. Your use of the Service is at your own risk.

(b) We will use Commercially Reasonable Efforts to ensure that the Service is secure and cannot be accessed by unauthorised third parties.

(c) We shall not be liable or responsible to you or to any third parties for any losses, damages, costs or expenses suffered by such person(s) arising out of or in connection with the rejection of your application or its non-acceptance or use, withdrawal, restriction, cancellation or termination of the Service resulting from or in consequence of any act or omission by us except in the case of our willful default or gross negligence.

(d) We shall not be responsible for any Transactions carried out by you through the Service. We will use our Commercially Reasonable Efforts to assist you with any error or mistake made in effecting any Transaction. However any dispute between you and the transacting party must be resolved by you and such party.

(e) We shall not be liable for acting on a confirmation sent by you using your registered device. Such confirmation shall be deemed irrevocable and binding on you upon receipt by us notwithstanding any error, fraud, forgery, negligence, lack of clarity or misunderstanding in respect of the terms of such confirmation.

(f) Apart from liability that we cannot exclude by law, we will not be liable for any losses you suffer as a result of using the Service, including losses arising from:

(i) a mistake you have made in your transfer instructions.

(ii) any fraud committed by another Mobile Wallet customer or third party, unless caused by us.

(iii) any delays or losses arising from a failure of the Network.

(iv) our inability to provide the Service due to Force Majeure or other events beyond our reasonable control.

We shall make available online information with respect to Transactions carried out by you. This information may be accessed through our Website at https://www.PayPlus.om . You may also request such information in writing from us from time to time by calling the Call Centre.

Information relating to your use of the Service, your name and other personal information may be made available to NBO, Ooredoo, CBO, other partners, other regulatory or governmental agencies or other third parties to enable us to open or manage your Wallet Account or to prevent or detect crime. You agree to the use of your personal information by us in this manner.

Ooredoo will be sharing the KYC information including your name, personal information and ID proof documents pertaining to existing subscribers registering for Pay+ wallet with NBO / CBO for verification purposes and upgrading the Pay+ wallet account to full KYC registration (subject to TRA and CBO approvals)

(a) Any disputes regarding billing or any Transaction(s) conducted using the Service must be notified to the Call Centre within three (3) days from the date of such transaction(s). You shall furnish us with all necessary supporting documents. If we do not receive written notice within three (3) days, you are deemed to have agreed that the bills and Transactions are accurate and you will have to pay the amount as billed for using the Service. If there is a dispute regarding the amount in any bill, you will promptly pay any outstanding amount which is not in dispute. If the dispute is resolved in our favour, you will pay the disputed amount immediately plus interest on any late payment, any legal costs and collection expenses incurred by us.

(b) You agree and consent to the disclosure and release by us of any information in our possession relating to you, particulars of transaction(s) or any designated account relating to the Transaction(s) for the purpose of investigating any claim or dispute arising out of or in connection with the Transaction(s) relating to the Service. Your consent shall survive the termination of the Service.

(c) You agree that in the event of a dispute or claim of any nature arising in respect of any transaction, the records of the transaction(s) available from us will be used as a reference and shall be the sole basis for settling such dispute or claim.

(i) If in our opinion, you have indulged in any dishonest, fraudulent, illegal or criminal conduct or misrepresentation relating to the Service;

(ii) You are in breach of any of the provisions of this Agreement or have engaged in any conduct prejudicial to us;

(iii) You have submitted false documents or have declared false information during your application for the Service;

(iv) your SIM card is no longer operational or is cancelled; and

(v) We cannot provide the service to you. We will make reasonable efforts to inform you that we have terminated this Agreement.

(d) CBO regulations will apply to any funds left in your Wallet Account after this Agreement has ended.

(e) Subject to this Agreement, termination of the Service will result in automatic closure of your Wallet Account.

(f) Unless this Agreement is terminated for suspected illegal activity, subject to any applicable CBO regulations, you will be entitled to recover any E-money left in your Account on termination by presenting your identification papers at any Ooredoo Outlet..

(g) This Agreement may be terminated due to Force Majeure as set forth in Clause 18.

(a) You will pay prevailing fees and charges relating to Transactions carried out using the Service. The applicable fees and charges shall be based on our prevailing rates as set forth on the Website at https://www.PayPlus.om , or the Pay+ Mobile App.

(b) Charges will be automatically deducted from your Wallet Account at the time any Transactions are carried out.

(c) You can see recent activity in your Wallet Account by accessing this information from the Mobile Wallet application.

(d) You will not be charged for your Wallet Closure.

(e) You will not be charged for downloading Wallet Transaction Statement.

(f) A fee of OMR 2 will be charged to customers for wallets that remain inactive on the (Pay+) Application for a period exceeding 5 years.

(a) You will not tamper or allow anyone to tamper with your Equipment or the Service.

(b) You must immediately notify the Call Centre and report to the Police any loss, fraud, suspected fraud, dishonest use or theft of your Equipment or illegal use of your Wallet Account. You will be liable for all charges incurred in relation to the lost or stolen Equipment or fraudulent use of the Service until we receive notification from you or disconnection of the Service.

(c) Notwithstanding the above, we may reject payment in respect of any Transaction if the Service is suspected to have been fraudulently used or tampered with.

(d) Mobile Wallet may enforce a change in your Passcode, if checks that we carry out to determine your identity or account registration at any time suggest your Wallet Account has been compromised.

We shall not be liable for any loss or damage suffered, if any, by you as a result of any of the circumstances described in this Clause 13.

(a) We may immediately terminate, suspend or impose conditions or restrictions on you in respect of the use of the Service or change the procedures or mode of operation of the Service without giving any reason or notice.

(b) You may request us to end this Agreement or terminate the Service by contacting the Call Centre at any time. The Service will be assumed to be terminated on receipt of your notification to us.

(c) Notwithstanding Clause 14(a), we reserve the right at any time, to immediately suspend or terminate your use of the Service for any reason, including but not limited to the following circumstances:

(d) Mobile Wallet may enforce a change in your Passcode, if checks that we carry out to determine your identity or account registration at any time suggest your Wallet Account has been compromised.

We shall not be liable for any loss or damage suffered, if any, by you as a result of any of the circumstances described in this Clause 13.